As homeowners we’re constantly seeking ways to make our living spaces more energy-efficient and environmentally friendly. If you’re considering home improvements that boost energy efficiency, here’s some news. The IRS offers a valuable incentive known as the IRA 25C tax credit in Whittier, CA. This tax credit rewards you for making energy-efficient upgrades to your home reducing both your energy bills and your tax liability. Let’s take a look at the key details of the IRA 25C Tax Credit. Here’s how you can take advantage of this opportunity to save money while contributing to a greener future.

Understanding the IRA 25C Tax Credit

The IRA Section 25C Residential Energy Efficient Property Credit encourages homeowners to invest in energy-efficient improvements. By making these upgrades you not only reduce your energy consumption but also qualify for a tax credit that directly reduces your tax liability.

Eligible Improvements

- Adding insulation to your home’s roof, walls, and floors can significantly reduce heat loss and gain.

- Upgrading to energy-efficient windows and doors helps improve insulation and minimize drafts.

- Installing reflective or cool roofing materials can lower your home’s cooling costs.

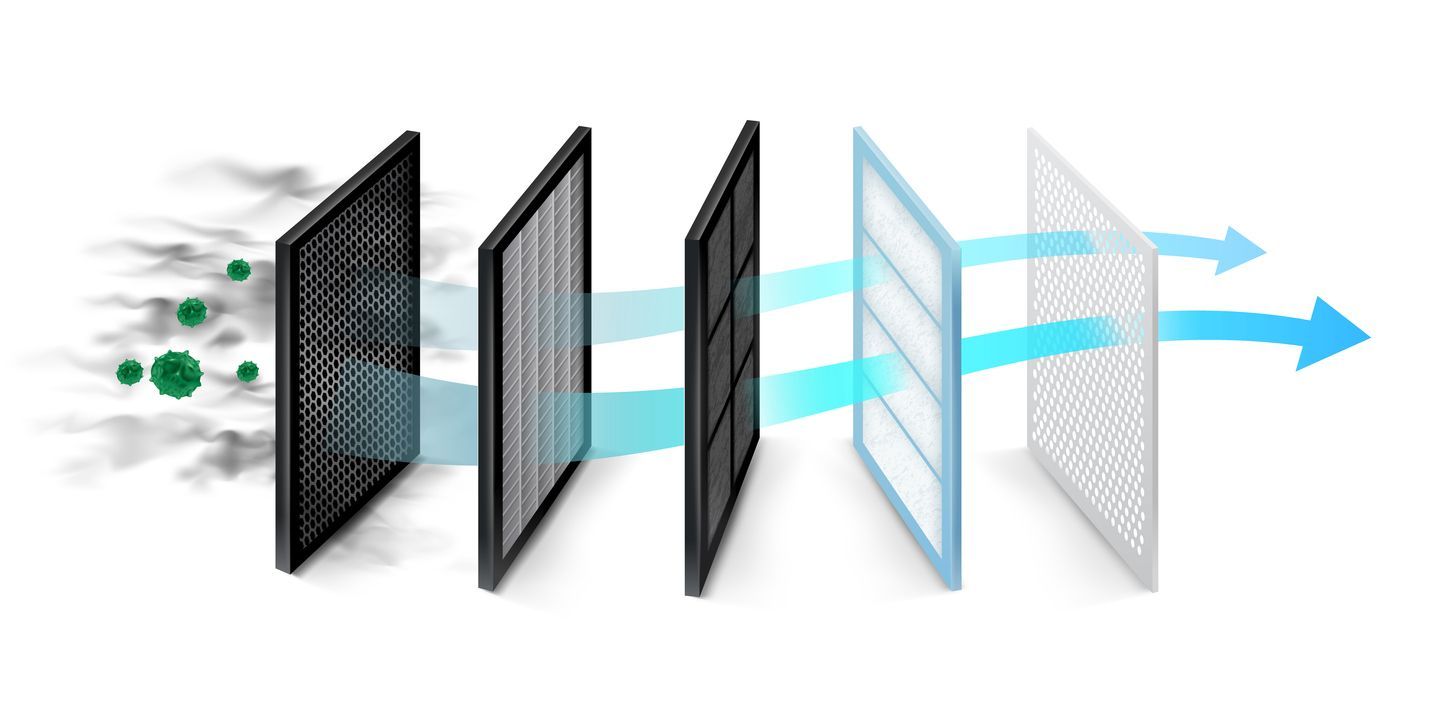

- Replacing or upgrading your HVAC system to a heat pump can yield huge energy savings.

- High-efficiency water heaters such as solar or heat pump water heaters are eligible for the credit.

- Installing certain energy-efficient biomass stoves can also qualify you for the credit.

Key Details

The IRA 25C Tax Credit offers a credit of up to 30% of the cost of eligible improvements, with a maximum credit of $600 per upgrade. The credit has a lifetime cap of $600 meaning that if you’ve claimed the credit in the past the amount you’ve already used will be deducted from the current credit. The IRA 25C Tax Credit has been extended to 2032.

Taking Advantage of the Credit

- Save all receipts, manufacturer certifications, and any other documentation that proves your eligibility for the credit.

- When filing your taxes, complete IRS Form 5695 to claim the Residential Energy Efficient Property Credit.

- Tax laws can be complex and a tax professional can guide you through the process and ensure you’re claiming the credit correctly.

The IRA 25C Tax Credit presents homeowners with a unique opportunity to improve the energy efficiency of their homes while enjoying tax savings. By making eligible energy-efficient upgrades you not only contribute to a more sustainable future but also enjoy reduced energy bills and a lower tax liability. Be sure to research eligible improvements, maintain proper documentation, and consult a tax professional to ensure you’re maximizing the benefits of this tax credit. Don’t miss out on the chance to make a positive impact on both your finances and the environment!